The upgraded CAFTA 3.0, finalized in May 2025, aims to deepen economic ties by covering areas like the digital economy, green economy, and supply chain connectivity, with a trade value of $234 billion in Q1 2025. This agreement is expected to be signed before the end of the year, promoting deeper integration of production and supply chains.

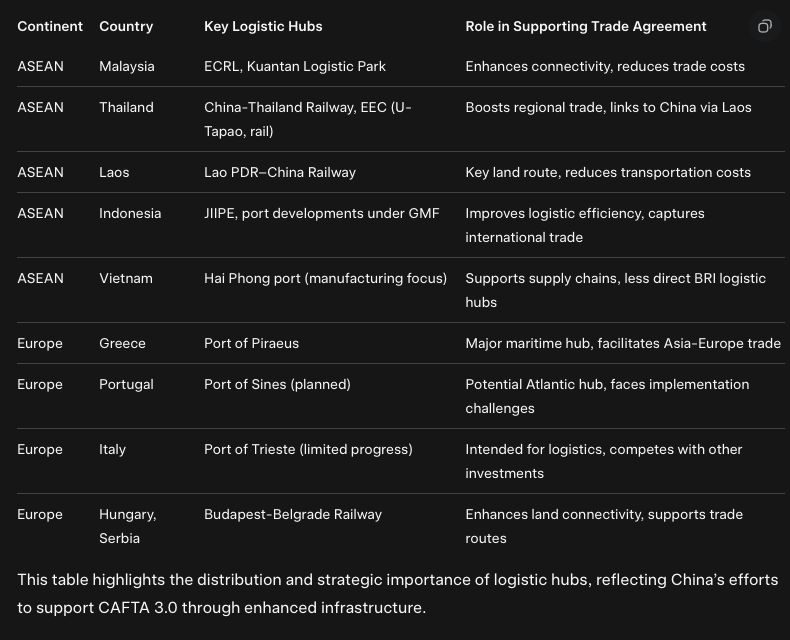

China’s Support Through Logistic Hubs

China supports these agreements by investing in logistic infrastructure under the BRI, facilitating trade between China, ASEAN, and Europe. These hubs enhance transportation and connectivity, crucial for the agreement’s success.

- In ASEAN: Projects like Malaysia’s ECRL and Kuantan Logistic Park, Thailand’s railway and EEC, and Laos’ railway are key, with Indonesia showing potential in port development.

- In Europe: The Port of Piraeus is a significant hub, with planned expansions in Sines and Trieste, alongside rail connections like Budapest-Belgrade.

For more details, see Reuters on CAFTA 3.0 and Carnegie on BRI impacts.

Comprehensive Analysis of China-ASEAN Trade Agreements and Logistic Hubs

This section provides a detailed examination of the recent trade agreements between China and ASEAN countries, focusing on the upgraded ASEAN-China Free Trade Area (CAFTA 3.0), and explores how China supports these agreements through logistic hubs in ASEAN and Europe under the Belt and Road Initiative (BRI), also known as the New Silk Road. The analysis is structured by country and continent, offering a thorough overview for stakeholders interested in regional economic dynamics.

Background on the Trade Agreement

The most recent trade agreement between China and ASEAN is the upgraded version of the ASEAN-China Free Trade Area (ACFTA), often referred to as CAFTA 3.0. Negotiations for this upgrade began in November 2022 and were completed on May 21, 2025, as reported by Reuters. This agreement introduces nine new chapters, focusing on emerging areas such as the digital economy, green economy, and supply chain connectivity. It aims to inject greater certainty into regional and global trade, promoting deep integration of production and supply chains. The trade value between China and ASEAN reached $234 billion in the first quarter of 2025, underscoring the economic significance of this partnership. The agreement is expected to be submitted to leaders for signing before the end of the year, as noted in a July 12, 2025, Reuters article.

China’s Support Through Logistic Hubs in ASEAN

China’s strategy to support the CAFTA 3.0 involves leveraging the BRI to develop logistic hubs across ASEAN, enhancing trade connectivity. These hubs include ports, railways, and industrial parks, which facilitate the movement of goods and reduce trade costs. Below is a country-by-country breakdown:

- Malaysia: Malaysia hosts significant BRI projects, including the East Coast Rail Link (ECRL), a 665-kilometer railway connecting the east and west coasts, built by China Communications Construction Company (CCCC). This project, costing around $11 billion, enhances regional connectivity and trade, as detailed in a 2025 report from the State-owned Assets Supervision and Administration Commission of China. Additionally, the Malaysia-China Kuantan International Logistic Park is a key logistic hub, fostering trade and investment, as mentioned in a 2024 CDR News report.

- Thailand: Thailand’s BRI projects include the China-Thailand railway, with plans to connect Bangkok to Khon Kaen, Nong Khai, and eventually China, aligning with the BRI’s goals. This project, highlighted in a 2023 Xinhua article, aims to enhance logistics, particularly by linking with the China-Laos Railway. The Eastern Economic Corridor (EEC) also involves investments in U-Tapao airport expansion and high-speed rail, boosting manufacturing and logistics, as noted in a 2019 CGTN report.

- Laos: The Lao PDR–China Railway, completed in 2021 at a cost of $6 billion, is a flagship BRI project connecting Kunming, China, to Vientiane, Laos. This 1,000-kilometer railway, built mostly by Chinese contractors, increases international logistic networks and reduces transportation costs, as discussed in a 2023 Carnegie Endowment report.

- Indonesia: Indonesia’s engagement with the BRI focuses on its Global Maritime Fulcrum (GMF) strategy, which includes developing 24 new ports to reduce logistic costs and capture international trade. Projects like the Java Integrated Industrial and Port Estate (JIIPE) near Surabaya offer port facilities and industrial parks, aligning with BRI goals, as outlined in a 2021 OBOReurope article. The “Two Countries, Twin Parks” scheme also involves industrial parks with logistic systems, as noted in a 2023 Jamestown report.

- Vietnam: Vietnam’s involvement is more cautious, with a focus on manufacturing rather than direct BRI logistic hubs. However, Chinese investments in ports like Cai Mep have faced challenges, with stalled acquisitions by China Merchants Port Holdings, as reported in a 2020 Nikkei Asia article. Northern Vietnam’s logistics infrastructure, including Hai Phong’s deep-sea port, benefits from Chinese manufacturing investments, as mentioned in a 2025 Vietnam Briefing article.

- Other ASEAN Countries: Projects like the Muara Terminal in Brunei and the Melaka Gateway in Malaysia, mentioned in a 2018 CARI ASEAN report, also contribute to logistics, though specifics are less detailed. Cambodia and Myanmar have seen infrastructure developments, but logistic hubs are less prominent compared to the above countries.

China’s Support Through Logistic Hubs in Europe

In Europe, the BRI, or New Silk Road, focuses on both maritime and land routes, with logistic hubs enhancing connectivity to China. Key developments include:

- Greece: The Port of Piraeus is a major BRI hub, with COSCO purchasing a majority stake in 2016 and planning a €600 million investment by 2026, as reported in a 2019 CNBC article. This port, now the seventh largest in Europe, facilitates trade between Asia and Europe, as noted in a 2023 Xinhua article.

- Portugal: The Port of Sines is a potential BRI hub, with Chinese interest in a €640 million container port project, as mentioned in a 2025 Portugal Homes article. However, actual investments face competition from the US and have not fully materialized, as noted in a 2021 Portugal Resident article.

- Italy: The Port of Trieste was part of Italy’s 2019 BRI memorandum, with plans for Chinese investment in logistics platforms, as discussed in a 2019 South China Morning Post article. However, recent developments, including a 2020 investment by Germany’s HHLA, suggest limited progress, as reported in The Diplomat.

- Rail Connections: The Budapest-Belgrade railway, part of the BRI, enhances land connectivity, with progress noted in a 2020 Carnegie Endowment report. Other rail routes, like China-Europe freight trains, also support logistics, as mentioned in a 2024 BELT AND ROAD PORTAL article.

Comparative Analysis by Continent

To summarize the logistic hubs and their roles, the following table provides a structured overview:

This table highlights the distribution and strategic importance of logistic hubs, reflecting China’s efforts to support CAFTA 3.0 through enhanced infrastructure.

Conclusion

China’s support for the upgraded CAFTA 3.0 through logistic hubs under the BRI is evident in both ASEAN and Europe, with significant investments in railways, ports, and industrial parks. While ASEAN countries like Malaysia, Thailand, and Laos see robust developments, Europe’s hubs, particularly Piraeus, are critical for maritime trade. Challenges in implementation, especially in Vietnam and Trieste, underscore the complexities of such initiatives, but the overall strategy aims to deepen economic ties and facilitate trade connectivity.