How purchasing goods and services in foreign currencies works. What is the role of central banks and how exchange rate fluctuations are compensated and the implications of rising of Asian currencies vs Western currencies.

1. Mechanism to Purchase Goods and Services in Foreign Currencies

When a company or individual buys goods or services from a foreign country, the transaction typically involves foreign exchange (FX or forex) operations. Here's how it works:

Step-by-Step Process:

- Agreement on Currency: The buyer and seller agree on the currency of the transaction—usually either the exporter’s local currency or a major reserve currency like USD or EUR.

- Currency Exchange: If the buyer doesn't hold the required currency, they must convert their domestic currency into the seller's currency. This is done through:

- Payment Transfer: Once the currency is exchanged, the buyer sends the funds through the international banking system (e.g., via SWIFT).

- Settlement: The seller receives the agreed-upon amount in their local or requested currency.

2. Role of Central Banks in FX Transactions

Central banks do not usually get involved in every private FX transaction, but they play a crucial macroeconomic role:

Key Roles:

- Stabilizing the National Currency: They may intervene in the forex market by buying or selling their own currency to influence its value.

- Maintaining Currency Reserves: Central banks hold large reserves in foreign currencies (USD, EUR, etc.) to manage exchange rate stability and meet international obligations.

- Setting Monetary Policy: Interest rate decisions influence capital flows, which affect currency demand and hence exchange rates.

- Providing Exchange Rate Regimes: Countries may have:

3. Compensation for Exchange Rate Fluctuations

Foreign exchange rates change constantly due to supply-demand forces, and this can create risk for international transactions. Businesses and investors use hedging strategies to mitigate this risk:

Main Methods of Compensation:

- Forward Contracts: A contract to exchange currency at a future date at a fixed rate.

- Options Contracts: Gives the right (not obligation) to exchange at a specific rate.

- Natural Hedging: Matching revenues and costs in the same currency (e.g., selling and buying in USD).

- Invoicing in Stable Currencies: Exporters may invoice in USD or EUR to avoid FX risk.

For example, if a European company buys goods from Japan and pays in yen, but the yen strengthens after the purchase agreement, the euro cost goes up. Hedging mechanisms can lock in the rate to avoid this loss.

4. Consequences of Asian Currencies Rising vs USD and EUR

If Asian currencies such as the Chinese yuan (CNY), Japanese yen (JPY), or Korean won (KRW) appreciate against USD or EUR, several effects emerge:

Trade Impacts:

- Asian exports become more expensive for foreign buyers → may reduce competitiveness.

- Imports into Asia become cheaper → benefits consumers and lowers production costs for import-heavy sectors.

Investment Flows:

- Foreign investments into Asia may decline due to reduced profitability for dollar/euro investors.

- Asian investors may buy more foreign assets, given higher purchasing power.

Inflation and Monetary Policy:

- Stronger local currencies lower import inflation.

- Central banks may cut interest rates to maintain export competitiveness.

Global Economic Balance:

- Countries like the US and EU may benefit from cheaper Asian imports, but suffer from trade deficits widening.

- Could lead to pressure for trade barriers or currency interventions.

5. Consequences of Gold Value on Currencies

No major national currency is officially pegged to gold — meaning, there’s no currency with a direct, fixed exchange rate to the price of gold, like under the historical gold standard. However, there are some nuances worth exploring:

1. No Currency Is Fully Gold-Backed Today

- The gold standard era ended decades ago — most notably with the U.S. dollar leaving it in 1971 (the "Nixon Shock").

- Today, all major currencies are fiat currencies, meaning they are not backed by a physical commodity like gold, but by the economic strength and credit of the issuing government.

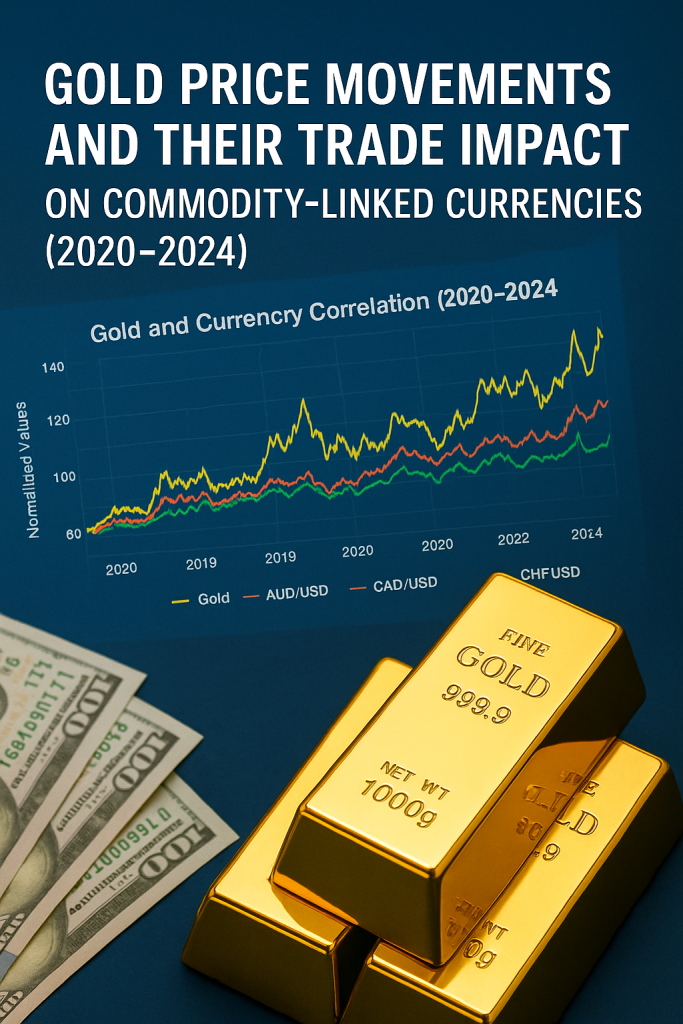

2. Currencies Closely Correlated with Gold

While not pegged to gold, some currencies tend to track or move similarly to gold prices, due to their countries’ roles as major gold producers or holders:

Highly Correlated Currencies (positively correlated with gold price):

CurrencyCountryReason for CorrelationAUD (Australian Dollar)AustraliaOne of the largest gold exporters in the worldCAD (Canadian Dollar)CanadaMajor gold (and commodity) producerZAR (South African Rand)South AfricaMajor gold mining economyCHF (Swiss Franc)SwitzerlandTraditional safe-haven; large gold refining industryRUB (Russian Ruble)RussiaOne of the top gold-producing nations (though volatile due to geopolitics)

These currencies often appreciate when gold prices rise, due to:

- Increased export revenues

- Capital inflows into resource-based economies

- Perception as safe havens (esp. CHF)

3. Countries with Gold-Related Reserves Policies

Gold-heavy central bank reserves:

- Russia, China, India, and Turkey have been steadily increasing their gold reserves to diversify away from USD-denominated assets.

- While not pegging their currencies to gold, this strategy indirectly links the strength of their monetary systems to the value of gold.

5 - Conclusion

As global trade dynamics continue to evolve, an increasing number of countries are exploring alternatives to the U.S. dollar for international transactions. This shift carries significant implications for global businesses. Buyers and sellers alike will need to reassess their currency strategies to ensure that trade agreements are financially sound and future-proof.

In this context, identifying and selecting the right transaction currency becomes a critical decision. Executives will need to consider currencies that offer long-term stability and minimal volatility in order to safeguard profit margins, reduce exposure to currency risk, and avoid cost inflation in future procurement and investment cycles.

Proactive currency planning—aligned with geopolitical trends and macroeconomic indicators—will become a key component of international financial strategy. Organizations that anticipate these changes and adapt early will be better positioned to negotiate favorable terms, maintain pricing stability, and build resilient global operations.