The CHIPS Act (Creating Helpful Incentives to Produce Semiconductors) is a landmark U.S. federal law designed to boost domestic semiconductor manufacturing, research, and supply chain security, primarily in response to global chip shortages and rising competition from China. It is a central component of U.S. industrial policy tied to national security, technological leadership, and the future of digital transformation—including AI, IoT, and Industry 4.0.

Key Facts

- Full name: CHIPS and Science Act

- Signed into law: August 9, 2022

- Public Law: 117-167

- Total funding: ~$280 billion (including ~$52.7 billion specifically for semiconductor-related activities)

- Administered by: U.S. Department of Commerce

Objectives of the CHIPS Act

- Reinforce U.S. chip production capacity (manufacturing subsidies & tax credits).

- Fund R&D for next-gen semiconductors and AI/quantum technologies.

- Enhance STEM and advanced tech workforce development.

- Reduce dependence on Asia-based supply chains (esp. Taiwan and China).

- Strengthen U.S. competitiveness in strategic sectors like defense, AI, IoT, 5G, Industry 4.0, etc.

Major Funding Streams

| Purpose | Budgeted Amount |

|---|---|

| Manufacturing incentives | $39 billion in subsidies |

| R&D (National Semiconductor Technology Center, etc.) | $11 billion |

| Workforce development | Part of R&D funding |

| Investment tax credit (25%) | Estimated $24 billion |

Impacts on the Market

a - Strengths / Opportunities

| Area | Effect |

|---|---|

| Chip Manufacturers (US & Allies) | Massive incentive to invest in U.S. fabs (e.g., Intel, TSMC, Samsung) |

| AI & IoT Startups | Benefit from stable chip access and R&D ecosystem |

| Industry 4.0 | Improved reliability of local chip supply = less production risk |

| Digitalization Projects | More resilience in procurement for advanced computing solutions |

| Geopolitical Leverage | Reduces tech dependence on geopolitical rivals like China |

b - Stresses / Weaknesses

| Issue | Risk/Challenge |

|---|---|

| Execution delays | Long timelines to build fabs (3–5 years typical) |

| Skilled labor gap | Shortage of qualified engineers and technicians |

| Global retaliation | EU and Asian nations launched similar subsidy programs in response |

| Inflationary costs | Construction and material costs rising rapidly |

| Capital concentration | Mid-sized firms and startups may be crowded out by mega players |

Global Responses by Country

United States

- Beneficiaries: Intel, Micron, GlobalFoundries, and new U.S. fabs from TSMC (AZ), Samsung (TX).

- Push: U.S. sovereignty in critical tech (defense, telecom, autonomous systems).

China

- Response: Doubling down on “Made in China 2025,” heavy investments via SMIC.

- Risk: U.S. export controls and CHIPS Act limit access to advanced U.S. chip technology.

European Union

- EU Chips Act (launched 2023): €43 billion in support; aims for 20% global chip share by 2030.

- Focus: Advanced nodes, automotive chips, RISC-V, sustainability.

South Korea

- Strategic Push: Samsung and SK Hynix increasing investments in R&D and U.S. fabs.

- Leverage: Maintaining competitiveness while securing access to U.S. and EU markets.

Japan

- Renewed interest in chip production with support for firms like Rapidus (with IBM).

- Goal: Regain relevance in advanced semiconductor production.

Taiwan

- TSMC building U.S. fabs, but remains critical to global supply chain (especially <5nm).

- Challenge: Geopolitical risk makes clients seek geographic diversification.

Consequences for Digitalization & Industry 4.0

- More secure chip supply → reduced delays for IoT, AI edge devices, industrial sensors.

- Higher U.S./Western production → More reliable sourcing for EU/US manufacturers.

- Increased cost pressures for firms outside U.S. incentive zones.

- Innovation acceleration in photonics, edge AI, embedded computing, quantum chips.

Summary of Key Players Impacted

| Segment | Examples | Expected Outcome |

|---|---|---|

| US chipmakers | Intel, Micron, GlobalFoundries | Major funding boosts and tax credits |

| Asian chip giants | TSMC, Samsung | Incentivized to open U.S. fabs; geopolitical balancing |

| IoT/AI firms | NVIDIA, AMD, startups | Benefit from R&D and stable chip supply |

| Industrial OEMs | Siemens, ABB, GE Digital | Improved planning, reduced chip-based delays |

| Digital integrators | SAP, Oracle, Microsoft | Can count on robust infrastructure for AI/ML/IoT tools |

Here is an industry-specific analysis for the sectors mentioned under the "Impact on the Market" section—Chip Manufacturers, AI & IoT Firms, Industry 4.0 Integrators, and Digitalization Projects—in light of the CHIPS Act:

1. Chip Manufacturers

Impact:

- U.S. firms (Intel, Micron, GlobalFoundries) receive direct subsidies and tax incentives to expand domestic production.

- Foreign leaders (TSMC, Samsung) investing in U.S.-based fabs become eligible for funding—but must restrict expansion in China.

Strategic Shifts:

- Reshoring of critical manufacturing.

- Diversification of production beyond Taiwan and South Korea (geo-risk mitigation).

- Focus on sub-5nm node development within U.S. territory.

Risks:

- High CAPEX requirements and lengthy ramp-up times (3–5 years).

- Labor shortages for specialized fab roles (engineers, technicians).

2. AI and IoT Firms

Impact:

- Greater access to U.S.-produced chips—critical for smart devices, edge computing, and AI inference.

- Boost in AI accelerator chip availability (e.g., for NLP, CV, etc.).

Opportunities:

- Reduced supply chain volatility, enabling faster product iteration.

- Support for custom silicon development and edge AI chips via R&D funding.

- Closer partnerships with fabless chip designers benefiting from the Act (e.g., AMD, NVIDIA, Qualcomm).

Challenges:

- Costs may still remain high until U.S. fabs reach scale.

- Talent war intensifies, particularly for hardware-aware AI developers and embedded system engineers.

3. Industry 4.0 (Smart Manufacturing, Automation)

Impact:

- More stable chip supply for robotics, sensor systems, PLCs, and autonomous industrial equipment.

- Encourages regionalized production ecosystems aligned with national industrial policy.

Benefits:

- Less risk of disruption in critical machine control systems due to chip shortages.

- Easier integration of real-time analytics and digital twins via edge computing.

Strategic Trends:

- U.S. and allied nations may become more attractive for greenfield Industry 4.0 investment.

- Embedded AI systems in machinery become more viable and cost-predictable.

4. Digitalization Projects (ERP, MES, IIoT Platforms)

Impact:

- Digital transformation programs are less likely to be stalled due to hardware delays.

- Cloud and hybrid infrastructure vendors (AWS, Azure, Google Cloud) benefit from long-term chip access and partnerships.

Implications:

- Predictable hardware delivery timelines improve ROI modeling and execution schedules.

- Data processing power at the edge (via AI-enabled chips) allows for more autonomous systems with lower latency.

Summary Table

| Sector | Positive Outcomes | Key Risk |

|---|---|---|

| Chip Manufacturers | Large-scale U.S. investment, market share protection | Long ramp-up, talent shortage |

| AI & IoT Firms | Stable access to advanced semiconductors | Cost and competition for chip supply |

| Industry 4.0 | Reliable sourcing for automation & control | Dependence on U.S. policy shifts |

| Digital Projects | Hardware-backed resilience for digital rollouts | Potential chip overspecification/cost |

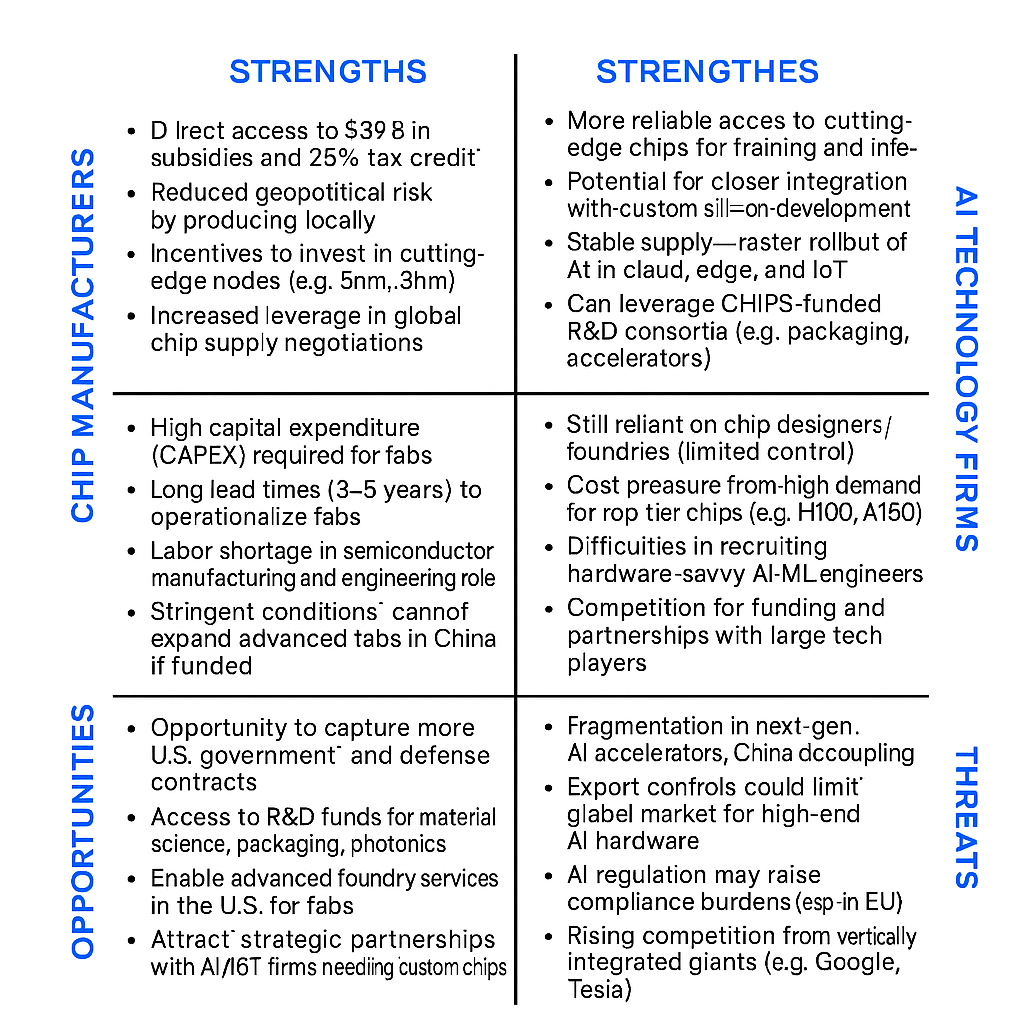

Here is a strategic SWOT analysis for both Chip Manufacturers and AI Technology Firms based on the CHIPS Act's implications:

1. Chip Manufacturers – SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Direct access to $39B in subsidies and 25% tax credit. | High capital expenditure (CAPEX) required for fabs. |

| Reduced geopolitical risk by producing locally. | Long lead times (3–5 years) to operationalize fabs. |

| Incentives to invest in cutting-edge nodes (e.g., 5nm, 3nm). | Labor shortage in semiconductor manufacturing and engineering roles. |

| Increased leverage in global chip supply negotiations. | Stringent conditions: cannot expand advanced fabs in China if funded. |

| Opportunities | Threats |

|---|---|

| Opportunity to capture more U.S. government and defense contracts. | Retaliatory subsidies from China, EU, and South Korea (subsidy race). |

| Access to R&D funds for material science, packaging, photonics. | Overcapacity risk if global demand slows post-2025. |

| Enable advanced foundry services in the U.S. for fabless firms. | Inflation and raw material volatility. |

| Attract strategic partnerships with AI/IoT firms needing custom chips. | Risk of tech leaks, IP theft in joint ventures. |

2. AI Technology Firms – SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| More reliable access to cutting-edge chips for training and inference. | Still reliant on chip designers/foundries (limited control). |

| Potential for closer integration with custom silicon development. | Cost pressure from high demand for top-tier chips (e.g., H100, A100). |

| Stable supply = faster rollout of AI in cloud, edge, and IoT. | Difficulties in recruiting hardware-savvy AI/ML engineers. |

| Can leverage CHIPS-funded R&D consortia (e.g., packaging, accelerators). | Competition for funding and partnerships with large tech players. |

| Opportunities | Threats |

|---|---|

| Collaborate on next-gen AI accelerators, neuromorphic chips. | Fragmentation in global chip availability (China decoupling). |

| Expand into hardware-software co-design for AI edge devices. | Export controls could limit global market for high-end AI hardware. |

| Tap into federal R&D infrastructure (e.g., NSTC). | AI regulation may raise compliance burdens (esp. in EU). |

| Integrate AI in more industrial and government use cases. | Rising competition from vertically integrated giants (e.g., Google, Tesla). |

Strategic Impact of the CHIPS Act on Semiconductor Manufacturing and AI Technology: A Dual-Sector SWOT Analysis

Below is a link to the US department of commerce feedback on the CHIPS Law